International trade and counterfeiting challenges: a new digital solution that will traverse the borders – Part 2

Part 2 – Introducing K:blok – the digital solution to international trade and counterfeit challenges

Introduction

In February 2019, we (KOIOS Master Data) embarked on a successful year long research and development project focusing on “Using ISO 8000 Authoritative Identifiers and machine-readable data to address international trade and counterfeiting challenges”. This project was funded by Innovate UK, part of UK Research and Innovation. ISO 8000 is the international standard for data quality.

Part one of this article explains the challenges HMRC and the UK PLC face due to counterfeiting and misclassification when importing into the UK, and outlines a digital solution to solve those challenges. Upon which we won our Innovate UK grant.

This part of the article (part two) outlines the development progress made towards building a digital solution, how machine learning and natural language processing techniques were used during the year-long project and how the project can move forward.

K:blok – technology to traverse borders

To tackle the challenges outlined in part one, we developed a new software product, K:blok.

K:blok is a cloud application that allows importers to create a digital contract between the parties involved in the cross border movement of goods from the manufacturer to the importer/buyer. These parties can include: manufacturers, shippers, freighters, insurers and lawyers, amongst others.

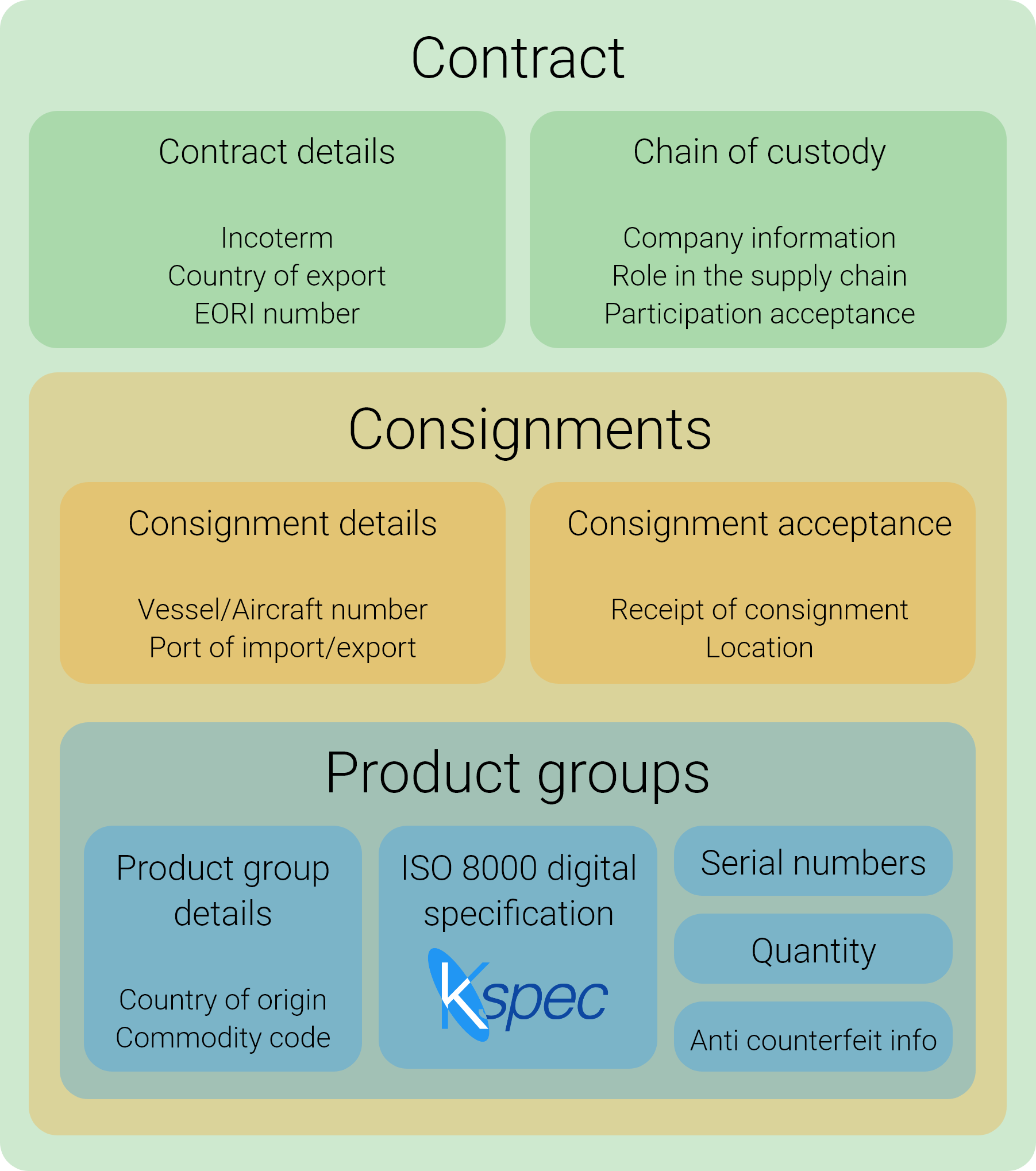

The contract brings together, in a single source, various pieces of data that are required to successfully and efficiently import a product into the UK and data that is not currently captured in any software system:

- ISO 8000 compliant, machine readable, multilingual product descriptions produced by the manufacturer of the products;

- ISO 8000 compliant Authoritative Legal Entity Identifiers (ALEI’s) for each organisation that participates in the trade;

- Accurate commodity codes for each product, the quantity of products, serial numbers and anti-counterfeit information (only visible to the manufacturer, the buyer and HMRC) to help validate the authenticity of the product;

- Trade specific information required for insurance and accountability, for example: the trade incoterm;

- Licensing and trading information about the parties in the contract, for example: Economic Operators Registration and Identification (EORI) number;

- Information regarding the route the product is taking, for example: the port of import into the UK, port of export from the original country of export, vessel/aircraft numbers and locations of the change of custody of the consignments.

The contract is digital, machine readable, can be exchanged without loss of meaning and is suitable for interoperating with distributed ledger technology, like blockchain.

This data can be accessed and used by any of the participants of the contract and analysed by HMRC. All of this data is captured before the goods are moved which, in turn, provides an intelligence layer and pre-arrival data on goods for HMRC analytics, to enable resources to be targeted at consignments deemed high risk.

This single source of data also provides buyers with an audit trail for their purchased products, which begins with the original manufacturer which assists with the authentication of the product received and can form the basis of an efficient global trusted trader scheme.

Natural language processing will help avoid misclassification

As discussed in part one, misclassification leads to the UK losing billions in tax revenue. Misclassification is both intentional and unintentional. Reducing the unintentional misclassification could save the UK millions in tax revenue.

There is a fundamental flaw in the current process of tariff code assignment. The party that currently assigns the tariff code is not usually the manufacturer of the product. Therefore, the party does not have the technical knowledge to classify the product correctly. This party also rarely has a full description of the product and resorts to using a basic description from an invoice to assign the code.

Currently, HMRC provides an online lookup and email service to enable UK businesses to assign the correct tariff code. However, there are concerns that the service is not time efficient. This concern will only get worse as more companies may have to classify their goods once the UK leaves the European Union (EU).

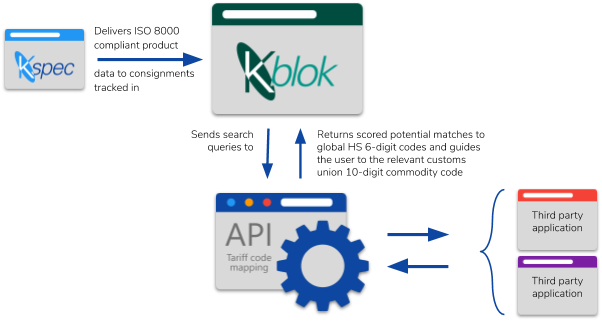

Therefore, as part of our project, we worked with two students from the University of Southampton, studying Computer Science with Machine Learning, to create an additional application programming interface (API) that links with the government tariff code API and uses natural language processing techniques to score a similarity between an input product description and the potential mapping to the correct tariff code.

This is accessible by manufacturers using the KOIOS software to link their ISO 8000 compliant product specifications to the correct commodity code for trading with the UK.

Techniques such as term frequency-inverse document frequency (tf-idf) and K-means were integrated into this API. Support Vector Machine (SVM), Random Forest and a Deep Neural Network (2 layers) have also been explored to improve the accuracy of the algorithm.

The API successfully improves on the searching capabilities of the government online lookup service within the product areas explored in this project – which were bearings and couplings.

KOIOS are uniquely positioned to continue the development of digital solutions for the UK PLC

Our Innovate UK project provides a foundation to achieve more efficient, cost-effective, cross border trading and to reduce counterfeit activities. We believe that data standards, including ISO 8000 can play a huge part in digitising and automating this process further.

We are ideally suited and uniquely positioned to continue the research and development of both the K:blok platform and the machine learning tariff classifier.

We also believe there is an opportunity to digitise the outdated, human readable tariff classification into a digital classification, using the international standards ISO 22745 and ISO 29002. These data standards sit at the core of all of the products in the KOIOS Software Suite. A digital version of the tariff classification will improve the accuracy, speed and reliability of computer automation.

Join us in our vision

Our successful Innovate UK project was a step in the right direction to improving international trade and reducing counterfeiting. Brexit also provides a great opportunity for the UK to become a world leader in using technology across borders and to set the standard for countries to follow.

In the coming months, we will continue to engage with the UK Government/HMRC and continue to look for opportunities to fund our research and development.

If you think that you can add value to this project and would like to explore how we could collaborate then please get in touch at info@koiosmasterdata.com.

Contact us

If you think that you can add value to this project and would like to explore how we could collaborate then please get in touch.

+44 (0)23 9387 7599